Metaverse Leaders Breakdown: Roblox

Roblox is a leading Metaverse virtual platform operator, with an average 55.3 million daily active users and over 48 billion hours of engagement from those users in the 12-months through November, 2022, up 361% and 414% vs. 2018. This means that on average, users spend 2.4 hours per day on the platform, or about one-third of average screen time. After such tremendous growth, where does Roblox go from here and what are the key catalysts to drive it forwards?

How Did Roblox Get Here?

Roblox’s tremendous growth stems from its dual-flywheel network effect and its ability to sustain these simultaneous drivers will be key to its ability to keep growing. Since its inception in 2006, Roblox has focused on building tools and resources to enable creative expression in digital worlds. This helped drive social bonds between players, their friends and creators. As the first generation of Roblox users became old enough to start making content, they brought in more players, more friends of players and more social interactions amongst these groups. As Roblox hosts more high-quality content made by increasingly professionalized developer organizations, it can continue to bring in more users, fueling more social interactions and attracting even more developers and creators to the platform.

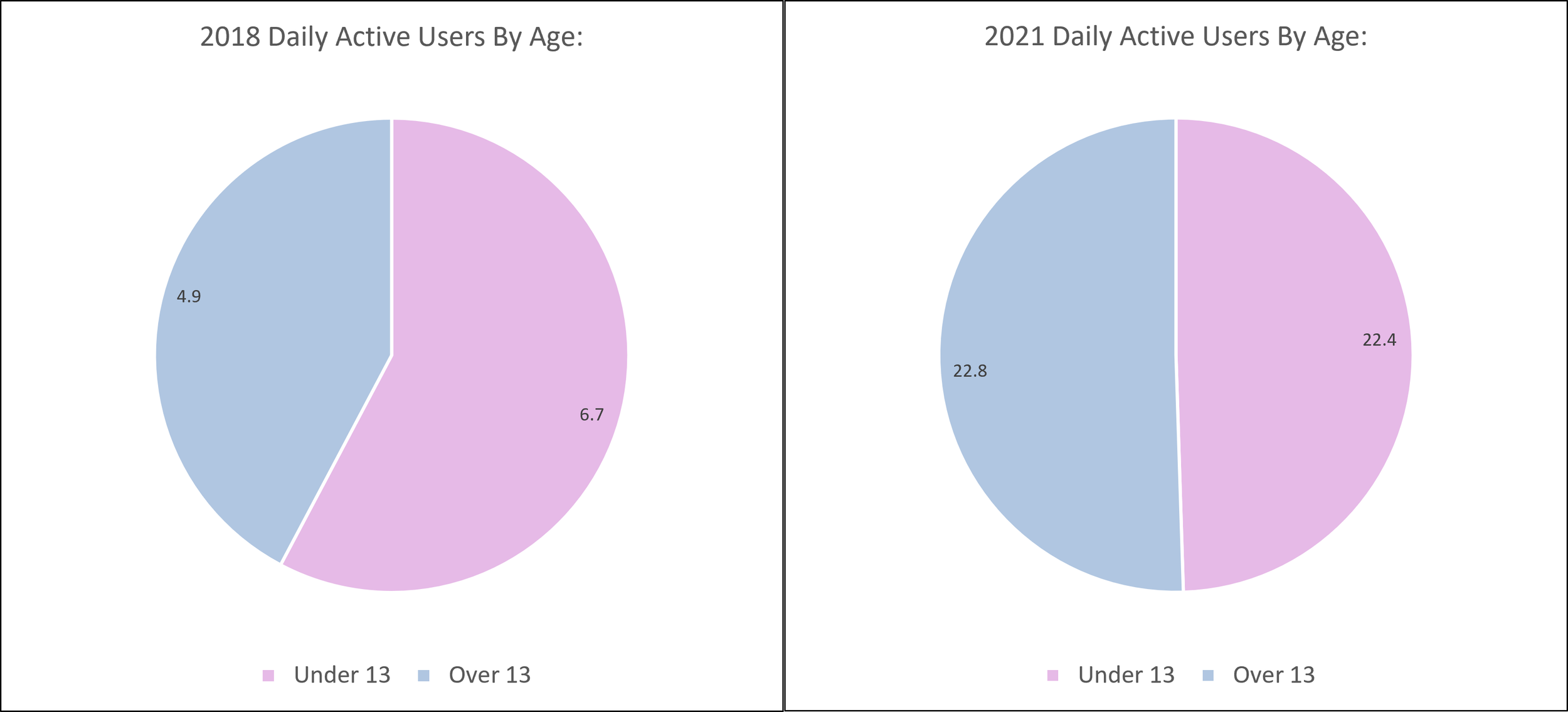

Roblox historically skewed to younger players, those under 13, who accounted for most of its users and hours of engagement. Over time, these younger users have stuck to the platform and “aged up” with it. A key risk for Roblox is that it can’t retain users as they get older, so the current trends have been encouraging. Roblox needs to keep attracting more high-quality content that addresses a broader range of demographics and preferences to remain relevant as these younger users get older and encounter more digital entertainment options, but so far it is doing this well.

Roblox Daily Active Users (Millions) By Age Group

Roblox daily active user breakdown by age range

With all of this tremendous growth behind us and the strong network effects built into the platform, what are the other catalysts to drive the next wave of growth and attract more users while increasing monetization and achieving profitability?

Subscriptions

Roblox has historically relied mostly on microtransactions for cosmetic avatar items to drive its monetization. Roblox’s gross bookings reached $2.8 billion in the 12-months through November, 2022. Each daily active user spent on average $50.59 over that period. But drilling into the numbers, only about 12 million users spend money per month and on average, they spend about $19 per month or over $200 per year.

So in comes subscriptions, an opportunity to extract more value from your highest-spending users (in gaming parlance, the whales). Roblox currently offers a suite of basic subscriptions that offer a top-off on their Robux, access to exclusive items and discounts, access to premium in-game experiences such as premium-only levels, items and boosters, the ability to trade items and more Robux from virtual currency purchases. Over time, expanding the suite of subscriptions to include experience-specific subscriptions, brand-specific subscriptions and others could further provide additional monetization avenues.

In particular, experience-specific subscriptions could help increase developer payouts and retain them as they can then get even better economics from the platform. In the 12-months through September, 2022, Roblox paid out about 23% of bookings in cash back to developers. Roblox pays out about as much of each dollar of bookings to developers as it does for payments costs and its spending on infrastructure, trust and safety but some argue this still isn’t enough.

Branded Experiences & Advertising

Roblox is scratching the surface for branded content and advertising but it’s already yielding quite strong results in terms of engagement. The next step will be driving deeper monetization from these experiences with more branded items, launching brand-specific experiences as discussed above and building an advertising platform and strategy to monetize users that don’t directly spend on items.

Some branded experiences on Roblox have already achieved massive scale, underpinning the success of combining experienced developer teams with popular brands. Sonic Speed Simulator from Gamefam has achieved over 600 million lifetime visits and is closing in on 60 million unique users, while NikeLand has nearly 30 million total visits and over 10 million unique users. As the share of engagement shifts increasingly to more professional, branded experiences, monetization can increase. Enabling more targeted advertising for brands to find the best users for their experiences and real-world products can build off of these experiences and provide additional revenue streams, particularly helping to monetize the large share of users that don’t spend.

Live Events

Live events are a very promising growth opportunity for Roblox, particularly around concerts and live sports. Roblox has been investing heavily in concerts, with notable successful concerts including Lil Nas X, 21 Pilots and Charli XCX. So far, concerts have been monetized like other branded experiences via verch. Although this is lucrative, it’s only scratching the surface. Verch (virtual merchandise) sales from Lil Nas X’s concert were about $10 million, a significant return for both Roblox and the artist.

With most artists making the bulk of their earnings from concerts and being on tour in the streaming era, there’s huge demand to host virtual concerts, enabling artists to reach more fans that either can’t afford the high cost of concert tickets or are geographically constrained from attending in-person events. Eventually, these events could even become ticketed and drive direct revenue from attendees, but the business model appears proven even for free events that monetize just from verch.

Growth is great but it doesn’t come without risks. What are the key risks to Roblox’s growth that it needs to overcome?

Aging Out Risk

We discussed above how Roblox historically skewed to a younger audience, with roughly half of its daily active users under the age of 13 and about 80% under the age of 21. Although the fastest-growing cohorts are in the 13-17 and 18-21 age ranges, skepticism remains over Roblox’s ability to retain users as they get older. Roblox’s ability to become the de facto social platform for these demographics and not just a gaming platform alongside attracting a broader range of high-quality content will be key to mitigating this risk.

Technology

A lot of work needs to be done to get the Roblox platform to a technical position where it can live up to its big expectations and plans. The maximum number of users that can exist in a Roblox server currently is about 500 (some can be 700). This is a far cry from the hundreds of thousands or millions of users we eventually want to host in virtual platforms in a true metaverse.

Roblox has ramped up capital expenditures, mostly on data centers to build redundant capacity in its network, spending over $300 million in the 12-months through September, 2022 vs. $100 million the prior 12-month period. It also has spent $439 million on research and development (excluding stock-based compensation) in the year through September, 2022 vs. $270 million in the prior 12-months. But this is still dwarfed by the capex and R&D budgets of large tech giants like Meta Platforms, Microsoft and Tencent that are also investing in their visions for the Metaverse.

Developer Payouts

As discussed above, Roblox only pays out about 23 cents of every dollar currently to developers but in reality, a small group of highly profitable developers account for the bulk of earnings. In 2021, only 7 developers earned more than $10 million while an additional 74 earned between $1 million and $10 million. The bulk of developers earn less than $1,000.

Although there isn’t a large pushback today from developers and there is no looming creator exodus, Roblox needs to continue to find ways to increase the share of revenue that developers can keep while maintaining platform investments. This is a delicate balance to strike but it can be achieved via new initiatives such as subscriptions and helping developers partner with brands to create branded experiences.

It’s important to remember that, although the share of payouts on Roblox is lower than other gaming platforms like mobile or consoles, the cost structure is vastly different and can make small teams profitable even with the lower share of payouts. Roblox provides many tools including the game engine, cloud servers, distribution and monetization - developers don’t have to individually source these. Whereas for a mobile or console game, developers pay the platform a commission for distribution and payments, pay for engine software, pay for other software tools and features and either need to separately source or create monetization tools. So even though the net payouts are lower on a percentage basis, the profit dollars can still be attractive.

Competition

It can’t be overlooked that many larger, much better-capitalized companies are also investing heavily to build their vision of the Metaverse. Those include Meta Platforms (previously called Facebook), Microsoft and Tencent. We already discussed Roblox’s capex and R&D spending the 12-months through September, 2022 of $300 million and $439 million. Meta Platforms has spent about $13 billion on its Reality Labs business and $28 billion on capex in the 12-months through September. Microsoft spent over $25 billion on R&D and $24 billion on capex. And Tencent spent about $8.5 billion and $3.5 billion.

What’s Next?

Roblox is well-positioned to execute on its several growth opportunities despite looming risks to continue to build towards its vision of the Metaverse. But can it overcome technical, competitive and demographic issues to reach this vision, especially in a time of a turbulent macroenvironment? Only time will tell.